How does Transactional funding work?

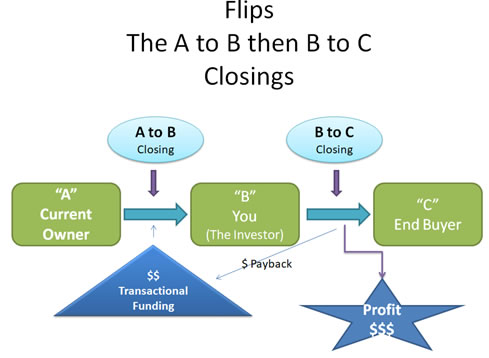

Transactional funding is funding sent to a title company on behalf of real estate investors planning to fund double real estate closings. To explain what a double closing, the buyers and sellers in the transaction are designated by the letters “A” (original property owner and seller), the investor “B” (both a buyer and seller), and the final buyer “C” who will be the final owner of the property.

It is also called Same Day Real Estate Closing or Double Closing because the actual time of this real estate transactions should happen on the same day. Depending on which state the property that is being sold is located in, different title companies may have different requirements to handle a flip. Once all the money and docs are in place for both transactions, they finish the transactional funder will fund the transactions to the title company handling the A to B transaction. Once the funds are received both transactions should close simultaneously and the transactional funder is paid back and the investor makes their profit.