Funding Real Estate Deals

Funding Real Estate Deals in Miami

Extended Transactional Funding Near Me

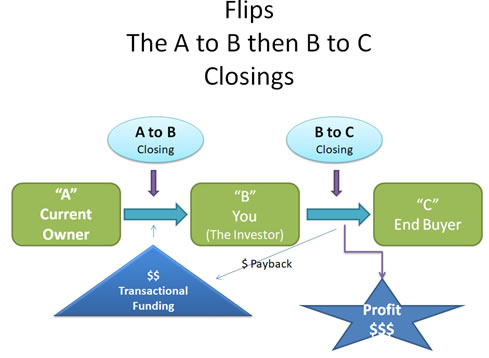

Funding a double closing has one of two ways that they are done in todays environment.

In the first case the person or entity purchasing the property brings funds to purchase the property and the Investore / wholeseller takes those funds and uses them to fund the closing of the first deal at the same time of the other closing. Florida still allows this process while other states have discontinued this process. So, investors and wholesellers can use their own money or they can locate transactional funding.

The other process is called transactional funding where the lender provides the full amount of the transaction needed to complete the first deal. This allows the investor to be able to complete the second transaction without having to use any of it's own capital. The Transactional Funding Lender simply charges a fee which is equal to a percentage of the transaction. The fees however, are generally more than the normal back rates. Which if you are an investor you are generally not surprised.

Different from hard money lenders, the transactional funding lenders regularly require a fast turnaround time in order to get their money back. This means that a double closing must take place with in 1 to 2 days and be completed.

What's In the News

Global Capital Partners Reviews Q3 Commercial Mortgage

As companies and investors move into the third quarter of the year, it is time to take a look at the commercial mortgage backed securities (CMBS) market.

Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. CMBS can provide liquidity to real estate investors and commercial lenders alike. Because there are no regulations for standardizing the structures of CMBS, their valuations can be difficult. The underlying securities of CMBS may include a number of commercial mortgages of varying terms, values, and property types—such as multi-family dwellings and commercial real estate. CMBS can offer less of a prepayment risk than residential mortgage-backed securities (RMBS), as the term on commercial mortgages is generally fixed.

As with collateralized debt obligations (CDO) and collateralized mortgage obligations (CMO) CMBS are in the form of bonds. The mortgage loans that form a single commercial mortgage-backed security act as the collateral in the event of default, with principal and interest passed on to investors. The loans are typically contained within a trust, and they are highly diversified in their terms, property types, and amounts. The underlying loans that are securitized into CMBS include loans for properties such as apartment buildings and complexes, factories, hotels, office buildings, office parks, and shopping malls, often within the same trust.