Alternative Lending Companies Miami

Private Lenders near me

Alternative Lenders Miami

Alternative lending for real estate has been around for decades and it utilized by people and corporations that get loans from non traditional methods. There are some great benefits for alternative lending, this includes: flexible options and providing more people the opportunity to qualify for a mortgage.

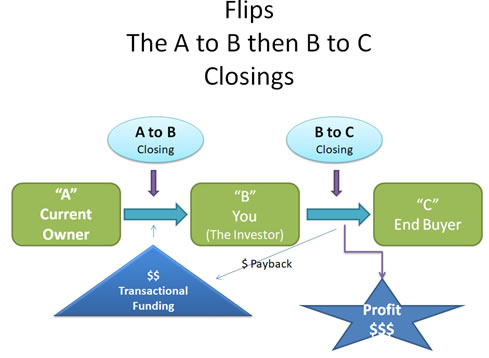

Alternative lenders work with title companies that are providing Transactional funding to real estate investors that are providing double closing's for real estate. To explain what a double closing, the buyers and sellers in the transaction are designated by the letters “A” (original property owner and seller), the investor “B” (both a buyer and seller), and the final buyer “C” who will be the final owner of the property.

It is also called Same Day Real Estate Closing or Double Closing because the actual time of this real estate transactions should happen on the same day. Depending on which state the property that is being sold is located in, different title companies may have different requirements to handle a flip. Once all the money and docs are in place for both transactions, they finish the transactional funder will fund the transactions to the title company handling the A to B transaction. Once the funds are received both transactions should close simultaneously and the transactional funder is paid back and the investor makes their profit.

What's In the News

Global Capital Partners Reviews Q3 Commercial Mortgage

As companies and investors move into the third quarter of the year, it is time to take a look at the commercial mortgage backed securities (CMBS) market.

Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. CMBS can provide liquidity to real estate investors and commercial lenders alike. Because there are no regulations for standardizing the structures of CMBS, their valuations can be difficult. The underlying securities of CMBS may include a number of commercial mortgages of varying terms, values, and property types—such as multi-family dwellings and commercial real estate. CMBS can offer less of a prepayment risk than residential mortgage-backed securities (RMBS), as the term on commercial mortgages is generally fixed.

As with collateralized debt obligations (CDO) and collateralized mortgage obligations (CMO) CMBS are in the form of bonds. The mortgage loans that form a single commercial mortgage-backed security act as the collateral in the event of default, with principal and interest passed on to investors. The loans are typically contained within a trust, and they are highly diversified in their terms, property types, and amounts. The underlying loans that are securitized into CMBS include loans for properties such as apartment buildings and complexes, factories, hotels, office buildings, office parks, and shopping malls, often within the same trust.