Double Closing Real Estate Miami

Double Closing Real Estate Miami

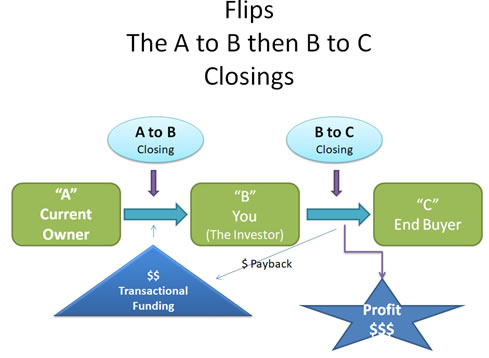

Double Closing Wholesaling

here are limitations however, which includes limitations on how funds can be used. For example, end buyers can no longer use the money used by the buyer to purchase the stated property from the official seller.

Not all Title companies are qualified to do double closings. The task requires skilled timing with a lot of moving procedures that govern the transaction. The Title company has to be investor friendly and seasoned in the process of the double closing in order for the process to go smoothly. Most title companies don't know what to do and how to do it, however, Quick Transactional Funding have done many complicated double closings. You can be assured that your transaction will go quickly and complete with result you need.

Real Investors utilize double closings because it is a very intelligent and creative way to complete and make profits from great deals. If your wholesaling distressed real estate or building a porfolio of passive income properties it is really the way to go. You have found a dependable partner in Quick Transactional Funding which will get the project done for you. Call them today.

What's In the News

Rand Merchant Bank (RMB), the corporate and investment banking arm of FirstRand pointed to a solid performance in its full-year financials, highlighting an 18% growth in core lending.

Pre-tax profit was up 17% from June 2021, and the ROE improved to 22.1% – up from 18.7% at June 2021, it said on Thursday (15 September).

“Our results showed a continued improvement in the credit quality of RMB’s core lending portfolio. We advanced R126 billion in new loans and refinancings across South Africa and broader Africa,” said RMB CEO James Formby.

The increase in client demand is a sign of improving confidence, especially as much of the funding is earmarked for South African investment, the bank said. “It is part of the reason that South Africa, and many of its businesses, are looking more attractive to investors again.”