Here are the Benefits and Negatives to a "Double Closing's"

Double Closing Miami

Double Close Real Estate Near Me

Benefitss of a Double Closing

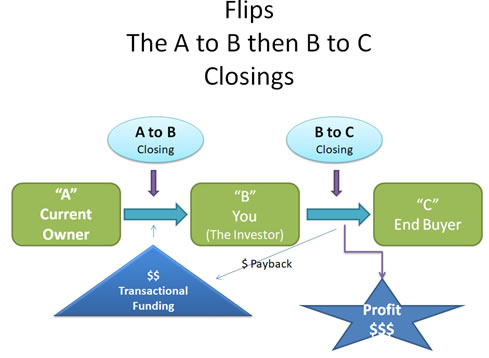

Double Closings have a lot of benefits. What different from the normal contract assignment is the double closing allows for more privacy. The seller are never aware of how much profit the investor is making, because the two completely seperate closing are happening at the same time and place. This is really important and beneficial if the investor is making a higher profit or if you are selling the property for a higher price than the original value thought by the seller.

It's crazy, but some sellers or buyers have known to back out of the deal, if they think the investor is making to much money. The double closing provides for privacy assuring that neither the seller or buyer know how much you are making.

Benefitss of a Double Closing

The cost of a double closing is generally more expensive then a simple assignment in order to cover the cost of the two closings. As the investor or the wholeseller you should be prepared and aware of this cost and factor that into your cost. In addition, the investor / wholeseller should be prepared to perform more work. The standard process for the closing is doubled. Bacically, everything that has to be done has to be done twice.

But, with all that taken into consideration to include increaased risk, the process is wll worth the effort because the investor can make much more on a deal then if they were doing a assignment deal. There are far less headaches from botht the seller and the buyer.

What's In the News

Mortgage rates hit 6%, first time since 2008 housing crash

WASHINGTON — Average long-term U.S. mortgage rates climbed over 6% this week for the first time since the housing crash of 2008, threatening to sideline even more homebuyers from a rapidly cooling housing market.

Mortgage buyer Freddie Mac reported Thursday that the 30-year rate rose to 6.02% from 5.89% last week. The long-term average rate has more than doubled since a year ago and is the highest it's been since November of 2008, just after the housing market collapse triggered the Great Recession. One year ago, the rate stood at 2.86%.