Alternative Lending Companies Miami

Private Lenders near me

Alternative Lenders Miami

Alternative lending for real estate has been around for decades and it utilized by people and corporations that get loans from non traditional methods. There are some great benefits for alternative lending, this includes: flexible options and providing more people the opportunity to qualify for a mortgage.

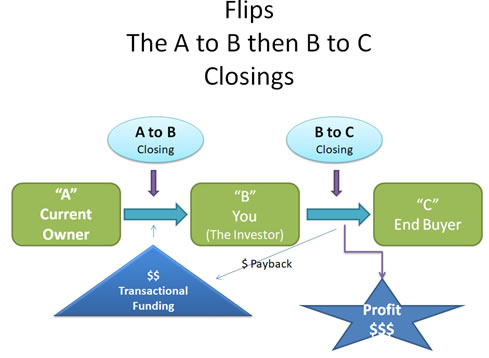

Alternative lenders work with title companies that are providing Transactional funding to real estate investors that are providing double closing's for real estate. To explain what a double closing, the buyers and sellers in the transaction are designated by the letters “A” (original property owner and seller), the investor “B” (both a buyer and seller), and the final buyer “C” who will be the final owner of the property.

It is also called Same Day Real Estate Closing or Double Closing because the actual time of this real estate transactions should happen on the same day. Depending on which state the property that is being sold is located in, different title companies may have different requirements to handle a flip. Once all the money and docs are in place for both transactions, they finish the transactional funder will fund the transactions to the title company handling the A to B transaction. Once the funds are received both transactions should close simultaneously and the transactional funder is paid back and the investor makes their profit.

What's In the News

Mortgage rates hit 6%, first time since 2008 housing crash

WASHINGTON — Average long-term U.S. mortgage rates climbed over 6% this week for the first time since the housing crash of 2008, threatening to sideline even more homebuyers from a rapidly cooling housing market.

Mortgage buyer Freddie Mac reported Thursday that the 30-year rate rose to 6.02% from 5.89% last week. The long-term average rate has more than doubled since a year ago and is the highest it's been since November of 2008, just after the housing market collapse triggered the Great Recession. One year ago, the rate stood at 2.86%.